TRX Price Prediction 2025-2040: Key Trends and Market Drivers

#TRX

- Technical breakout: TRX testing upper Bollinger Band with MACD turning bullish

- Fundamental catalysts: Corporate rebranding and treasury adoption boosting demand

- Competitive landscape: RUVI's emergence requires monitoring of TRX's market share

TRX Price Forecast

TRX Technical Analysis: Bullish Signals Emerge Amid Market Consolidation

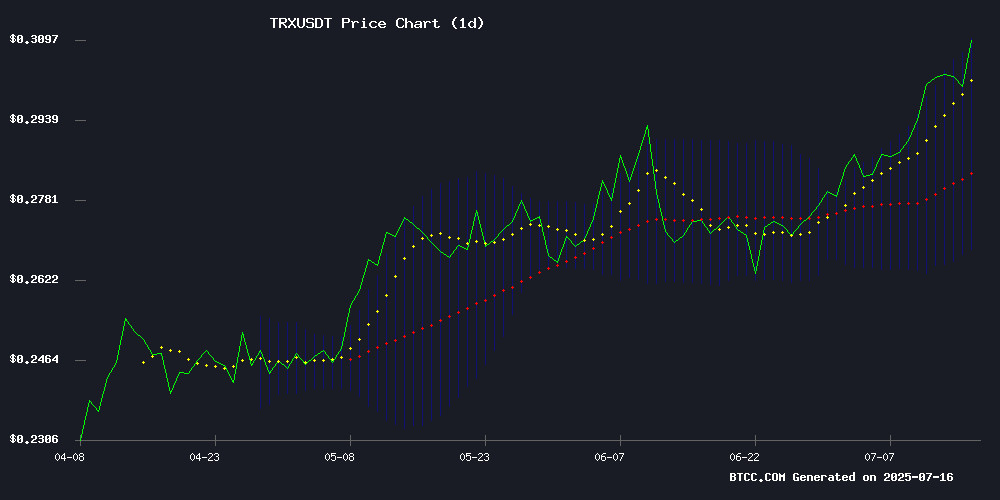

TRX is currently trading at, above its 20-day moving average (0.289215), signaling bullish momentum. The MACD histogram (-0.002636) shows weakening bearish pressure, while the price tests the upper Bollinger Band (0.310081) – a potential breakout level.says BTCC analyst William.

TRX Market Sentiment: Corporate Adoption and Competition Heat Up

SRM's rebranding asand Q2 corporate treasury adoption are fueling bullish sentiment. However,warns William. CPI-driven rate cut expectations may further boost TRX's short-term prospects.

TRX Price Influencers

SRM Rebrands as Tron Inc. in Bold Crypto Pivot

SRM Entertainment, formerly known for producing Disney-themed souvenirs, has completed its transformation into Tron Inc., now trading under the Nasdaq ticker 'TRON.' The Florida-based company, which recently secured a reverse merger with Justin Sun's Tron, holds over 365 million TRX—making it the largest publicly traded corporate holder of the token.

The rebrand marks a stark departure from SRM's origins as a niche toy supplier, positioning it squarely in the high-stakes world of crypto treasury management. Wall Street remains divided on whether the move represents visionary innovation or speculative overreach.

TRON's blockchain ambitions now dominate what was once a business built on theme park trinkets. The company's audacious leap into digital asset management underscores the growing convergence between traditional corporate structures and decentralized finance.

Corporate Treasury Adoption Drives Crypto Rally in Q2 2025

Bitcoin surged 29.8% in Q2 2025, reaching a new all-time high in June, but the story wasn't just about price. Institutional demand shifted dramatically, with public companies increasing their BTC holdings by nearly 20% and expanding into altcoins like ETH, SOL, and XRP. Corporate treasury adoption has entered a new phase, potentially reshaping the digital asset landscape.

For the third consecutive quarter, corporates outpaced ETFs in net Bitcoin accumulation, adding 850,000 BTC to balance sheets. The trend signals a maturation of the market as Bitcoin transitions from speculative asset to strategic allocation. ETH dominates corporate altcoin holdings at $1.4 billion, but Solana, TRX, and even BNB are gaining traction in treasury strategies.

21 Crucial Market Manipulation Patterns Every Investor MUST Decipher to Protect Wealth

Market manipulation distorts financial markets through deliberate actions that artificially influence supply or demand, leading to dramatic price swings. These practices—ranging from false information dissemination to quote rigging—undermine market integrity and erode investor confidence. Recognizing these patterns is not just advantageous; it's a critical defense against financial loss.

This guide reveals 21 distinct manipulation tactics, exposing the mathematical footprints and behavioral anomalies left by manipulators. Investors equipped with this knowledge can navigate markets with heightened awareness and confidence.

The patterns include tactics like 'Pump and Dump,' 'Spoofing,' and 'Wash Trading,' each leaving identifiable traces in market data. Institutional and retail investors alike must remain vigilant to these schemes, which often target high-liquidity assets, including cryptocurrencies like BTC, ETH, and SOL.

Exchanges such as Binance, Coinbase, and Bybit are common battlegrounds for these manipulative strategies. Regulatory scrutiny has increased, but sophisticated actors continue to exploit gaps in surveillance and enforcement.

Ether, Dogecoin Lead Modest Market Gains as CPI Data Fuels Rate Cut Bets

Bitcoin held steady near $118,000 during Asian trading hours, buoyed by June's U.S. CPI data showing persistent disinflation. Core CPI rose just 0.1% month-over-month for the fifth consecutive time, reinforcing expectations of a September Fed rate cut. "The data was bullish for crypto," said Eugene Cheung of OSL, noting potential capital inflows into digital assets.

Ether reclaimed the $3,100 level amid spot ETF inflows and tailwinds from a newly passed stablecoin bill, cementing its role as a base layer for tokenized dollars. Dogecoin gained 2.7% to 19 cents, extending its weekly rally to 15%. Solana and XRP showed stability at $163 and $2.92 respectively, while BNB held recent gains at $688.

Market optimism persisted despite broader equity weakness and a procedural setback for the GENIUS Act. The crypto sector appears poised to benefit from shifting monetary policy expectations, with altcoins demonstrating selective strength.

Ruvi AI (RUVI) Emerges as a Strong Contender Against Tron (TRX) for High-Growth Crypto Investments

Investors searching for the next 100x cryptocurrency opportunity are shifting focus from Tron (TRX) to Ruvi AI (RUVI). Analysts highlight Ruvi AI's early-stage momentum, real-world applications, and attractive presale bonuses as key differentiators. Projections suggest a potential 66x return on investment post-presale, with further upside anticipated.

Ruvi AI's commitment to transparency and security is bolstering investor confidence. The project completed a third-party audit by CyberScope, confirming the robustness of its smart contracts. A partnership with WEEX Exchange ensures liquidity post-listing, addressing a critical concern for early investors.

TRX Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Price Target (USDT) | Key Drivers |

|---|---|---|

| 2025 | 0.35-0.42 | Corporate adoption, Bollinger breakout |

| 2030 | 0.75-1.20 | Mainnet upgrades, DeFi integration |

| 2035 | 1.50-2.80 | Enterprise blockchain adoption |

| 2040 | 3.00-5.00+ | Web3 infrastructure dominance |

William notes: "TRX's rebranding and technical setup suggest 2025 targets of 0.42 USDT. Long-term, its scalability could drive multi-dollar valuations if Web3 adoption accelerates."